Dispatch: HSC’s Morning Take

Nguồn: HSC

HSC’s Morning Take

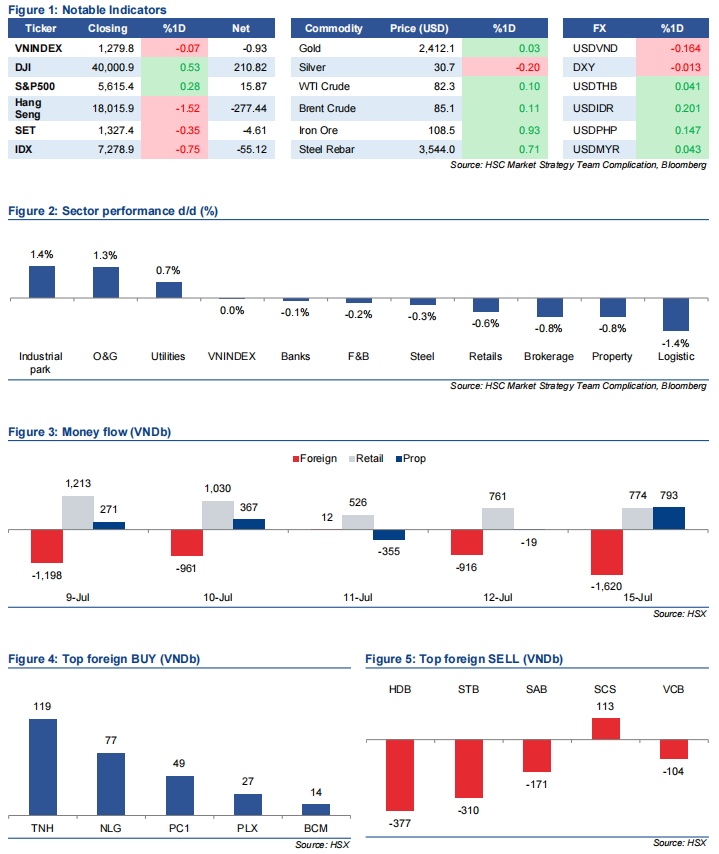

- The VN Index was stable with subdued liquidity (VND14.2tn) while foreigners net sold VND1.6tn/USD66.0mn.

- The market is expected to stay range-bound (1,290-1,250 points) due to weak buying interest; MACD and RSI suggest short-term corrections.

- Heavy foreign selling continues, but potential positive impact from upcoming draft circular to abolish prefunding. Rising interest rates expected to remain moderately low, easing FX rate and local currency pressure.

- Insurance sector improvements expected with new regulations and investment yield recovery in 1Q25; BVH is our top pick.

Continue to remain volatile in a range-bound manner

The VN Index was stable with subdued liquidity of VND14.2tn. Foreign investors remain net sold of VND1.6tn/USD66.0mn, focusing mainly on HDB and STB.

Our view

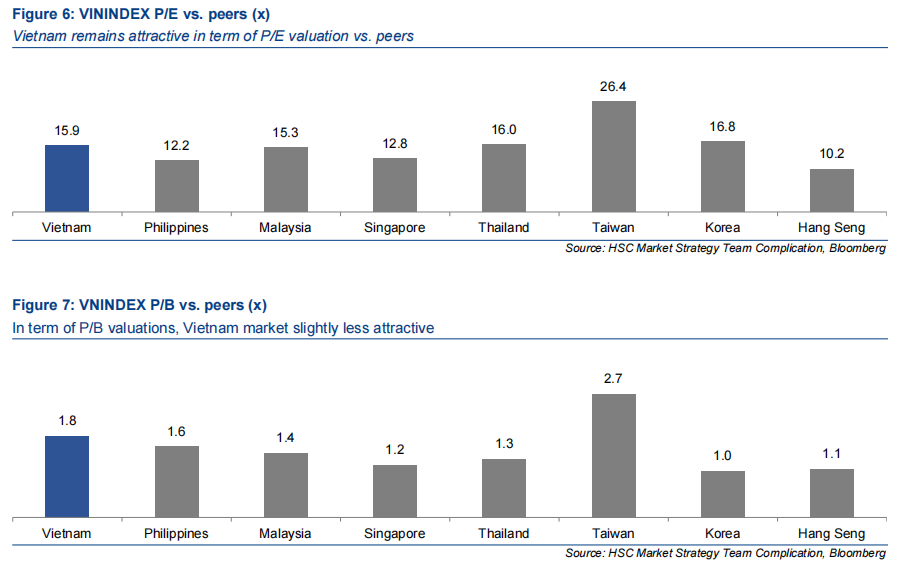

From a short-term technical standpoint, we anticipate the market to remain rangebound between 1,290 and 1,250 points due to a lack of buying interest, as evidenced by subdued liquidity. Both MACD and RSI indicators are signaling weaknesses, suggesting some short-term corrections are due. Retail investors are currently focused on short-term trading, resulting in sector rotations that are not substantial enough to attract participation from larger institutional funds.

However, we observed divergence even before the 2Q24 earnings results approached. While the earnings recovery hype typically fades quickly during this period as retailers take short-term profit, it does not lead to a major correction but rather to consolidation. Despite the lack of buying interest, the selling pressure is also diminishing, which could keep the index within its current range. For a longer-term point of view, we reiterate that the weekly chart analysis since August 2022 reveals a consistent pattern of corrections forming higher lows sequentially. Each consolidation phase preceding new highs has occurred in progressively shorter timeframes, indicating that the VN Index’s positive long-term trend remains intact.

In addition to our recent discussion about the significant net selling pressure from Foreigners and ETFs, we observed that Fubon ETF took proactive movement last week, resulting in net sales amounting to USD17.5m. This brought the MTD outflow to USD20.0m, lifting a total YTD net outflow of USD123.2m from their NAV of USD704.4m. It's worth noting that this ETF is highly sensitive to the Vietnamese stock market movements, with a strong historical tracking record. Therefore, the proactive selling by this fund at this juncture is also a signal that the Vietnamese market is extremely unpopular amongst the foreign investors at the moment. Again, despite heavy selling by foreigners, the index continued to consolidate, signaling that the return of foreigners in the near future may lift the index much further.

On another note, the Ministry of Finance may release the draft circular to abolish prefunding for public comments either this week or next. This draft is widely considered by market service providers to be well-rounded and more practical than the previous version. The market may react positively to this draft, and once implemented, it could contribute to help the index break out from its range bound pattern.

Key focus points

Overall interest rates are expected to remain moderately low and accommodative, pressure on FX rate and local currency is easing

Interest rates at commercial banks have been rising from their low levels in March, with the 12-month deposit rate increasing from 4.5-4.7% to the current 4.6-6%. This upward trend reflects banks' efforts to make deposits more attractive in preparation for higher credit growth expected in 2H24. A rising interest rate environment is generally less favorable for the stock market and property investments. However, we expect overall interest rates to remain moderately low and still accommodative, with only c.50- 100bps hike this year.

On a positive note, pressure on the FX rate and the local currency appears to be easing as we enter the third quarter. The DXY has faced some downward pressure with a 90% expectation of a Fed rate cut in September. The USD/VND rate has also cooled, with interbank, commercial and free market rates all cooling down.

HSC maintains a bullish stance on the insurance sector, with BVH as the top pick due to its market position, valuation, and liquidity

Our analyst Tung Nguyen just publish a well-rounded report on the Insurance sector. Please contact us for the full report. Tung sees signs of improvement in the insurance sector. The recent issuance of Circular 34/2024/TT-NHNN by SBV permits banks to engage in the sale of life insurance in accordance with the insurance law, reversing the previous draft's prohibition. Tung believes that in the long term, this new regulation will gradually revive the bancassurance distribution channel, but still going to enhance transparency in the insurance market and safeguarding end-users.

Moreover, as interest rates rebound from their lows, Tung anticipates the sector's investment yield to bottom out in Q424, with a recovery expected to commence in 1Q25, and which will also reduce provisions for life insurers. For now, we maintain a long-term bullish stance on the insurance sector, driven by the current low penetration rate and the robust growth of the economy, which we expect will translate into strong growth and profitability. While non-life insurance has shown stronger performance in 1Q24, our analyst’s top pick remains BVH, favored for its leading market position, attractive valuation (forward PB of 1.4x, 1.4 SD below its average), and ample liquidity.